Options trading for beginners is often overlooked. A lot of novice traders think that options trading is too risky, but if you use the right strategies, it can reduce your risk and even generate a bit of passive income.

The reason people think options are risky is that they see the results of the Reddit style “yolo trades” and see hundreds of thousands or millions of dollars evaporate overnight. Don’t get me wrong, investing and options carry risk, but it’s often disproportionate. Today, I’m going to cover options trading for beginners. Let’s start with the very basics — what are options?

What are options?

Options are a contract between a buyer and seller where the buyer reserves the right to buy or sell a stock at a predetermined price at an agreed-on date.

It is important to know, that an options contract represents the right to 100 shares of the stock. Keep this in mind since the price of options contracts are listed on a per-share basis. So a $1 contract is worth $100 ($1 X 100 shares). Now, let’s dive into some of the basic options trading terminology.

Options trading for beginners: key terminology

Before we go deeper, there are a few key options terms that you should understand. They are:

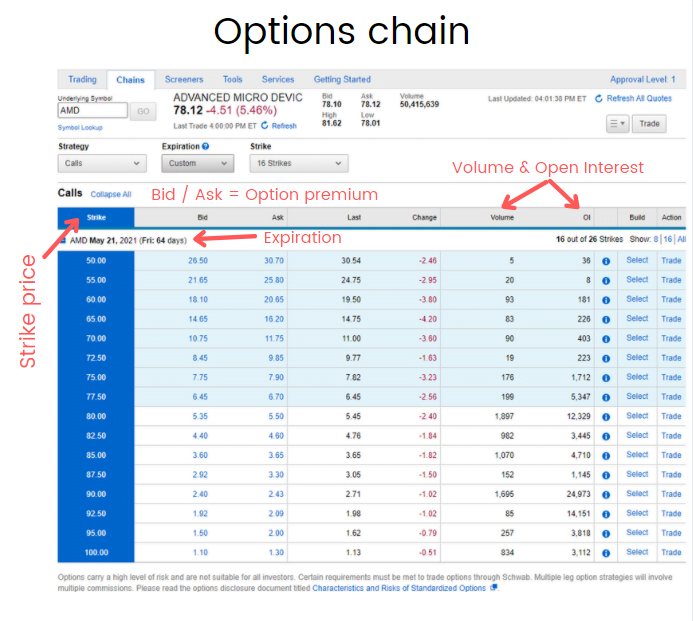

- Options chain – A list of all available options contracts.

- Option premium – The price the buyer pays for the options contract.

- Strike price – The negotiated price that the shares will be bought or sold at.

- Open interest – The total number of available contracts.

- Volume – The number of contracts that have been exchanged in a day.

- In the money – When the stock price is above or below the strike price. This depends on the type of options contract. More on this later.

- Expiration – The date that the options contract ends.

- Exercising a contract – The process when the buyer of the options contract decides to execute its terms and either buy or sell shares at the strike price.

Here’s a quick example of an options chain. Depending on the broker you use, it may look slightly different. However, the key information should be the same. This example is from my broker, Charles Schwab.

Types of options contracts

There are two main types of options contracts. The call option and the put option. They are inverse of one another. For example, when you buy a call option, you buy the right to buy the underlying stock at the strike price. When you buy a put option, you buy the right to sell the underlying stock at the strike price. So:

Call options give the buyer the right to buy 100 shares of a stock at the strike price at the specified expiration date. Call options increase in value as the price of the stock rises. You’ll want to buy them when you think the stock price will increase. Vice versa, you want to sell them when you think the price will go down or sideways. There is one exception to selling though, and that is if you are using it as an exit strategy.

Put options give the buyer the right to sell 100 shares of stock at the strike price at the specified expiration date. Put options increase in value as the price of the stock drops. So they are usually bought when the buyer thinks the stock price will go down and sold when the seller thinks the stock will trade sideways or go up.

Why trade options?

There are a few reasons why someone would want to trade options instead of stock. Options can give more flexibility like controlling more shares with less money (a form of leverage), reducing risk, and generating additional income.

So with stocks, you only profit if the share price increases. With options, you can profit if the price goes up, goes down, or even stays the same.

Trading options lets you take advantage of leverage. This means that you may be able to gain similar exposure to the movement of a stock’s price with less money. Of the benefits, this can be the riskiest.

You can reduce your risk by hedging your stock trades with options. To do this, you could buy shares of a particular stock and buy a put option to sell it at a certain price if the stock collapses. In finance, they call this the protective put. This is where my initial insurance reference comes into play.

Options can also generate income. Essentially, it is possible to replicate the effects of a dividend-paying stock with stocks that don’t pay dividends. This is one of the main reasons that some investors trade options. In my case, this is what got me into trading options. Common strategies include selling covered calls or cash-secured puts. We’ll dive into these a bit later.

Options vs. stocks: What’s the difference?

When you buy stocks, the goal is to buy low and sell for a profit. This profit is known as capital gains and is the primary way to earn money trading stocks. Another way is with dividends. A dividend is a payout that the company pays out to shareholders for owning the stock. Most commonly, dividend paying companies pay out each quarter.

If you recall, options are a contract between a buyer and seller that lets them either buy or sell 100 shares of stock in the future.

In this case, you aren’t holding the stock, only a contract to buy or sell the stock. You can make money with options if the stock goes up, trades sideways, or goes down while limiting your downside. Let’s look at a simple example of buying a call option vs buying the underlying stock.

Owning stock vs. buying a call option

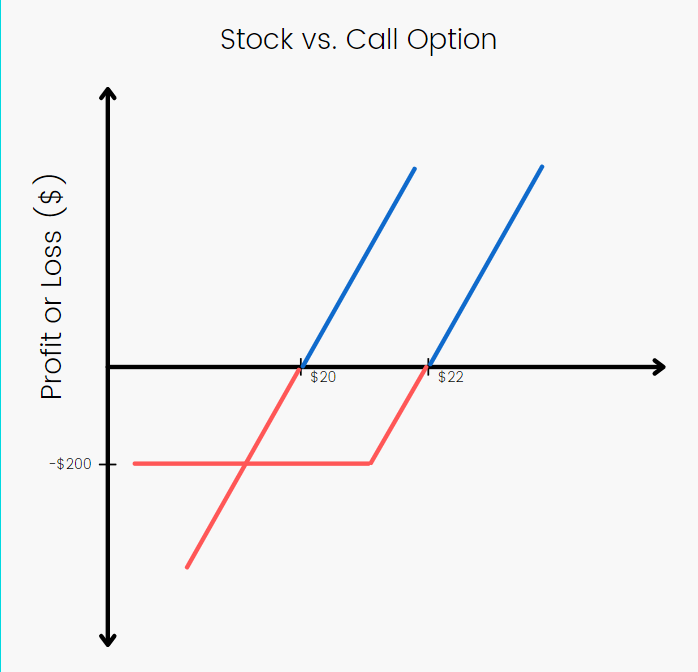

Assume that stock ABC trades for $20. This means that buying 100 shares would cost $2000. When you compare this to buying a call option, you’ll see where leverage comes into play.

For example, a call option with a strike price of $20 that expires 60-days from now has a $2 premium. So it would cost $200 ($2 X 100) to control the same 100 shares. Assume then that the break-even then for this options contract is $22 ($20 share price + $2 premium). A picture will illustrate this point better.

Now assume that the stock price goes up to $25 before the contract expires. In the case of owning the stock, you’ll profit $500 or 25%.

With the options contract, you’ll profit $300 or 150%. Because remember, the options contract had a $2 premium so your total investment was only $200.

Keep in mind, that if the stock is not above $20 at the time of expiration, you will lose 100% of your initial $200 investment.

Let’s say that on the expiration date, the stock is at $18. In the case of owning the shares, you’d be out $200. The same is true for the options contract. However, if you continue to hold the stock, you may be able to recoup your losses. Trading options contracts do not give you this flexibility.

Applying for options approval

Before you can start trading options, you need to apply for options approval with your broker. This is often overlooked by “options trading for beginners” guides.

The exact process depends on your broker, but usually, you need to provide your trading experience as well as your financial background. Then, based on your account type and the info you provide, your broker will assign you an options level. Here’s a general overview of how this works with TD.

While nothing is stopping you from lying, I highly recommend that you answer the questions truthfully. The options trading levels are meant to protect you just as much as they are meant to protect your broker. Now, let’s see what exactly is included in each of the options approval levels.

Options approval levels explained

Brokers usually have four options approval levels. Each level gives you access to additional options strategies. However, there isn’t a standard for what strategies can and cannot trade at a particular approval level so they differ from broker to broker. This table is a general overview of the typical strategies available at each approval level.

| Approval Level | Strategies Included |

| Level 1 | Covered calls, Protective put |

| Level 2 | Buying calls / puts |

| Level 3 | Credit / debit spreads |

| Level 4 | Uncovered or naked contracts |

Each increase in level includes all of the prior level’s strategies. So, in this case, level 2 includes long calls and puts as well as everything in level 1 while level 3 includes everything in level 2 and 1.

Understanding Call Options

Call options are a bullish bet for the buyer and a bearish bet for the seller. Think of it like this, the buyer wants the stock to go up and the seller wants the stock to trade sideways or go down.

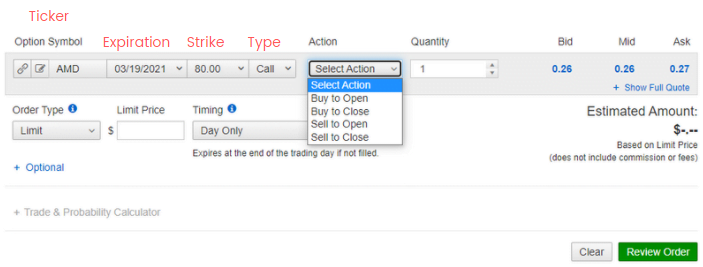

In this section, I will reference the options trade ticket several times. Give it a look and note the important fields.

In the screenshot you can see ticker, expiration, strike, type, action, quantity and order type. From these fields, action is the most complex. When you buy a contract, you put buy to open and when you sell a contract, you put sell to open.

Buying call options

When you buy a call option, you buy the right to purchase a stock at the agreed-on strike price. The best time to buy call options is on a red day. This minimizes the amount of premium that you pay for the contract. Take a look at the order sheet below.

When you submit an order to buy a call option, you pick the expiration date, the strike price, set the action to “buy to open”, enter the quantity, set the order type (I recommend using a limit), and the premium.

Possible outcomes

- If the stock price rises above your strike price, you can exercise the contract and buy 100 shares of the stock if you want to own it, but most commonly, the call option is just resold in this case.

- If the stock price is below the strike price at expiration, then it expires worthless and you lose 100% of its value.

Selling call options

When you sell a call option, you sell the right to buy a stock at the strike price. It’s best to sell call options on days when the underlying stock is up. This maximizes the premium you receive.

Choose the expiration date, the strike price, set the action to “sell to open”, enter the quantity, set the order type, and the premium you’d like to collect.

Possible outcomes

- If the stock price is below the strike price on expiration, the contract expires worthless and you keep the premium from selling the contract.

- If the stock price is above the strike price at expiration, the contract can be exercised and the seller must sell 100 shares at the strike price to the buyer.

Call options example

Understanding Put Options

Put options are a bearish bet for the buyer and a bullish bet for the seller. If you buy a put option, you want the stock to go down while the seller wants the stock to go up or trade sideways.

Buying put options

As you’d expect, you want to buy put options on green days to minimize the premium you pay and sell them on red days to maximize the premium you receive. Let’s see how this works in practice.

First pick the expiration date, the strike price, set the action to buy to open, enter the quantity, set the order type, and the premium. Again it’s best to use limit orders when dealing with options.

Possible outcomes

- If the stock price is below the strike price on expiration, the buyer has the right to exercise the contract by selling 100 shares at the strike price or resell the contract for a profit.

- If the stock price is above the strike price on expiration, then it expires worthless.

Selling put options

Inversely, the best time to sell put options is on a red day while the best time to buy is on green days.

First pick the expiration date, the strike price, set the action to sell to open, enter the quantity, set the order type, and the premium.

Possible outcomes

- If the stock price is below the strike price on expiration, then you are obligated to buy 100 shares of the stock at the strike price.

- If the stock price is above the strike price on expiration, then the put contract expires worthless and you get to keep the premium.

Put options example

Options trading for beginners: Strategies

Most “options trading for beginners” guides skip covering strategies. I don’t suggest you go out and try these immediately, but I do think they help reinforce how and why you’d trade options.

In my opinion, the most basic strategies for beginners include the covered call, cash-secured put, and the protective put.

What is a covered call?

A covered call is an options strategy where you own 100 shares of a stock and write call option contracts against them. It can be used to generate additional income on stocks that you own or be an exit strategy.

To set up a covered call, you need to own or buy 100 shares of a stock and sell a call option against them.

If you don’t already own the 100 shares of stock, some brokers let you buy and sell a call option against them all in one transaction. Others make you first buy the shares, then write the call option.

The downside of selling covered calls is you limit upside potential. It’s important to choose a strike price that are willing to sell your shares at in case the contract gets exercised. Remember, you can always buy back your call too if you don’t want it to get exercised.

Selling covered calls reduces your cost basis but doesn’t limit downside potential. The price of your shares can go down, but the golden lining is that as long as you sell covered calls above your cost basis, it’s impossible to lose money.

Tips:

- Buy 100 shares of stock in companies you want to own

- Sell calls above your cost basis

What is a cash secured put?

The opposite of a covered call is a cash secured put. A cash secured put is an options strategy where instead of writing against shares, you write a put contract against cash you already have in your brokerage account. You can use them to generate income off of cash.

To set up a cash secured put, you must have the amount of cash required to purchase a stock at the strike price. So, the strike price X 100.

Cash-secured puts are also a good method to generate income, but typically you would sell a cash-secured put when you want to buy the underlying stock at a lower price.

The downside of a cash secured put is the price of the stock you write the put contract against can potentially go to zero. At which point, you’re obligated to buy it at the strike price.

That is to say, if you’re ok holding the stock that you are writing cash secured puts against long term, then there isn’t anything to lose.

Tips:

- Only sell against stocks you want to own

- Sell puts at or below a price you are willing to pay

What is a protective put?

As the name implies, a protective put can limit your downside risk. You do this by buying 100 shares of a stock and a put contract at the same time. If the stock drops, you’ll limit how much you can lose to the strike price minus the premium that you paid. This is the case where options behave similarly to insurance. The only downside here is that you’ll be paying a premium which reduces your profits on the trade.

However, if you’re trading incredibly risky and volatile stocks short term, then this may be a strategy worth looking into.

Protective puts are not something that I use because I only buy and hold stocks long term, thus short-term volatility doesn’t affect my portfolio and is not something I need to protect against.

Conclusion

I know this was a lot to digest. I hope you found this guide to options trading for beginners helpful.

My goal is that you come away with a basic understanding options trading terminology , the difference between a call option and put option, how they work, and when you’d use a covered call, cash-secured put, or protective put.

If you have any questions, drop a comment below!