I had a post by Funding Cloud Nine on budget categories come through my “Google Discover” feed. It was an enormous, monolithic list of 100+ budgeting categories. No one is really tracking that many categories, and for an effective budget, you don’t need to. It could even make your budget less effective if it becomes too much work to maintain. Before we take a look at budget categories, let’s briefly define what they are.

Budget categories are groups of related expenses that you use to track expenses for a personal budget. They usually include needs and wants like housing, food, and entertainment.

What categories should I include in my budget?

I broke down this list of budget categories into 10 easy-to-understand groups, and divided them into two groups. Needs-based expenses which are the things you need to survive, and non-essential spending which are the things you that you can do without but are fun.

When you start budgeting, you should begin by looking at your disposable income. This is defined as your income after taxes and deductions. Simply put, how much money you actually see put into your account each month. The percentages that I will use below to give an idea of how much to spend on each category will be based on this amount, not your gross income.

Need-based budget categories

Needs-based expenses are the most important expenses and will take the majority of your take-home pay to maintain. They are expenses that you have to pay in order to live and work like housing, food, transportation, medical expenses, saving, debt payments, etc.

Housing

Housing should account for everything related to keeping a roof over your head. Common expenses here include rent or mortgage payments, renter’s or home owner’s insurance, property taxes, HOA fees, and maintenance costs. This will probably be your largest expense in terms of a percentage of your income. Depending on your area’s cost of living and your income, this should account for anywhere between 20-35% of your income.

Food

Food expenses should include anything that is spent on food. I keep this category to grocery shopping exclusively and I aim to spend around 10-15% of my income. I prefer to categorize dining out as something non-essential because I could quite easily cut back if necessary. With that said though, feel free to include it here if that works for you. Especially if you don’t dine out very often.

Transportation

Transportation should reflect all of your expenses to get from point A to point B. This could be a public transportation pass, car payments, car maintenance, insurance, registration fees, gas, etc. I allocate 10-15% to transportation.

Utilities

Alright, I’m gonna cheat here a little bit so let me explain. Generally, this category is reserved for utilities like water, electricity, and heating/cooling. However, I also like to include internet and phone plans here as well since they’re just as essential today. On top of that, you may include your cable bill. I allocate 5-10% to utility costs.

Medical / healthcare

The medical/healthcare should track all of your health-related spending. Sometimes, budgets break out all of the different insurances into their own category, but I think that health insurance, home insurance, and auto insurance fit into the housing and transportation categories better. Here, I include things like medical insurance premiums, out-of-pocket expenses, dental expenses, medications, and anything else related to your health. It’s hard to give an estimate here since it depends quite heavily on your personal circumstances. If you’ve got a family, you’re gonna spend significantly more than if you’re single. As a general rule though, I spend anywhere from 10-15%. It’s totally ok to spend more too. Just account for it by reducing your other budget categories.

Saving & investing

If you’ve read my post on paying yourself first, you shouldn’t be surprised to see this here. Saving is an integral part of your financial health but is far too often neglected. Ideally, you should be contributing to an employer-sponsored retirement plan pre-tax. So here you’ll be accounting for any other saving or investing that you do. This could be things like building an emergency fund, saving for a down payment on a house, or additional investments outside of your retirement plan. I aim to contribute around 10-20% if I can.

Debt payments

Oftentimes, I see saving and debt payments lumped into one category. I find that strange since they’re hardly related. I also like being able to quickly see how much is going toward debt each month. It also happens to be a fantastic motivator to get rid of debt ASAP. A few exceptions here are if you have a mortgage or an auto loan. They should be recorded under housing and transportation. Otherwise, use this category to track things like student loans, other short-term debts, credit card payments, etc.

Non-Essential budget categories

After you’ve taken care of your needs, you’ll have what’s known as “discretionary income” leftover. All this means is that you can choose where you spend it.

While most of your needs-based expenses are fixed, these expenses tend to be variable because we don’t take vacations, or buy big-ticket items every month. These are the easiest expenses to cut back on if you need to.

Personal expenses

I was torn between where this should go. Ultimately, I decided to place it into the non-essential expenses category. While it does include things like personal hygiene products, it is quite generic because gym memberships, gifts, clothing, any subscriptions you may have, and — well, anything else that you’d likely buy for yourself will go here. Plan to allocate 0-10% of your take-home pay here.

Fun & entertainment

This category is self-explanatory, yet probably the most important to stay sane. This is where you should track everything fun that you spend money on. Be that dining out with friends, vacationing, video games, and other hobbies. Spend this money however you want. It can also be between 0-10% of your monthly income.

Miscellaneous

This category is a catchall. If something doesn’t fit into one of the above budget categories, or maybe you’ve maxed one of them out, you can track it here. Maybe you got a new job and had to buy a new suit, ruined your computer, or another irregular expense. Regardless of what it is, you can also allocate 0-10% of your income here.

How does it look in practice?

Now that you’ve got an idea, let me walk through how I proportion my budget categories. When you look at my numbers, remember that since I live in Ukraine, I’m able to take advantage of geoarbitrage. I don’t earn six figures. My income would be considered about average in the United States.

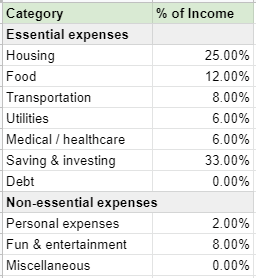

In terms of my needs, I spend 25% on housing, 12% on food, 8% on transportation, 6% on utilities, 6% on healthcare and save 33% of my income.

My non-essential expenses, on the other hand, make up just 10% of my monthly income with 2% covering personal expenses and 8% toward fun & entertainment.

Now, let’s break down how I decided on allocating these amounts to each category. For housing, I first defined what type of housing I’d like to live in. My criteria was a secure apartment in a safe neighborhood, near public transportation, with air conditioning and a washing machine. I then went to search the local apartment listings to get a feel for what this would cost. It’s important to define your housing criteria first because it’s very easy to overpay for things you don’t need.

For food, it was harder to judge in the beginning. It could also be lower, but as a foreigner, I have cravings. Like maple syrup which will set you back $10 here. On top of this, I occasionally buy nice cuts of steak.

A monthly transportation pass goes for around $30/mo here. On top of this, I frequently use Uber. Especially since its pandemic times and all. So typically, this would be lower during normal times.

Utilities are simply my water, heat, electric, phone, and internet bills. During the winter, my utilities are usually 20% higher. So I tend to base my utility costs on this and treat myself out at the end of the month in the summer.

Medical and healthcare include insurance, regular trips to the dentist, eye doctor, and family doctor. Since these expenses are not monthly occurrences, I just save 6% of my income in a separate account to cover them as they come up.

Saving is simple. I use the pay yourself first method and automatically deposit 33% of my monthly income into my Charles Schwab account.

Personal expenses are also kind of odd for me. I tend to buy hygiene products in bulk so that I get a discount once or twice a year. So much like medical expenses, I track this in a separate account and spend it as it comes up. I also buy a pair of shoes maybe once per year along with a few other items of clothing.

Fun & entertainment consists of weekend trips out of the city, dining, and going out with friends. All of which are fairly affordable where I live.

That’s all there is to budget categories

I hope this gives you an idea as to which budget categories you should use and how to break your budget down. The most important thing is to keep it simple enough so that you’ll stick with it.